عربي, 中文, Español, Français, 日本語, Português, Русский

The crisis has hit small and medium enterprises especially hard, causing massive job losses and other economic scars. Among these—less noticeable, but also serious—is rising market power among dominant firms as they emerge even stronger while smaller rivals fall away.

We know from experience and IMF research that excessive market power in the hands of a few firms can be a drag on medium-term growth, stifling innovation and holding back investment. Such an outcome could undermine the recovery from the COVID-19 crisis, and it would block the rise of many emerging firms at a time when their dynamism is desperately needed.

We see growing signs in many industries that market power is becoming entrenched.

Creating a more level playing field is now more important than ever. And governments will need to achieve it across a wide range of sectors—from brewing through hospitals to digital.

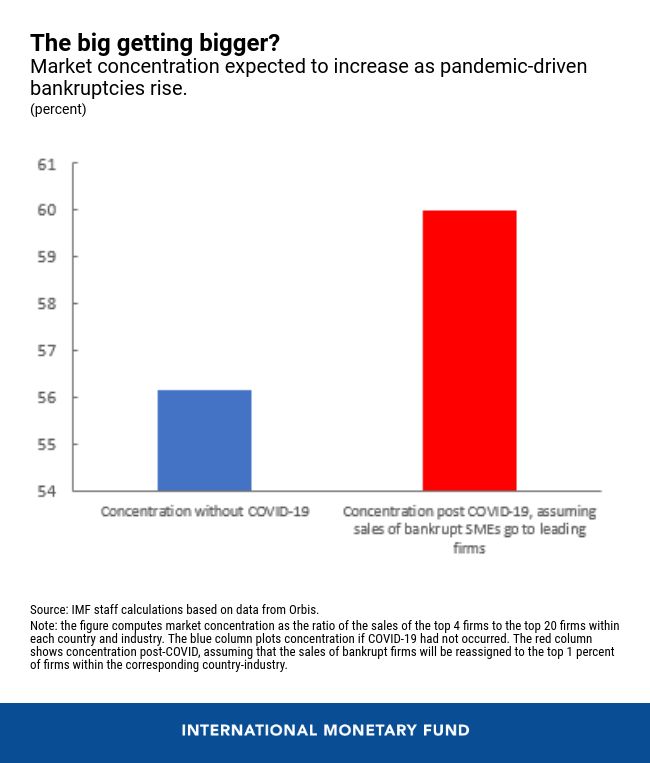

New IMF research shows that key indicators of market power are on the rise—such as the markup of prices over marginal cost, or the concentration of revenues among the four biggest players in a sector. Due to the pandemic, we estimate that this concentration could now increase in advanced economies by at least as much as it did in the fifteen years to end of 2015. Even in those industries that benefited from the crisis, such as the digital sector, dominant players are among the biggest winners.

A decades-long trend set to worsen?

A pandemic-driven rise in market power across multiple industries would exacerbate a trend that goes back over four decades. For example, global price markups have risen by more than 30 percent, on average, across listed firms in advanced economies since 1980. And in the past 20 years, markup increases in the digital sector have been twice as steep as economy-wide increases.

Of course, strong profits have historically been the natural reward for successful firms that displaced incumbents through innovation, efficiency, and improved service. Think of how Ikea transformed the way we buy furniture, or how Apple changed the market for mobile phones.

Recently, however, we see growing signs in many industries that market power is becoming entrenched amid an absence of strong competitors for dominant firms. Across different sectors, we estimate that companies with the highest markups in a given year (top decile) have an almost 85 percent chance of remaining a high-markup firm the following year—some 10 percentage points higher than during the “New Economy” era of the 1990s.

The big tech firms are a case in point: the market disruptors that displaced incumbents two decades ago have become increasingly dominant players that do not face the same competitive pressures from today’s would-be disruptors. Here the pandemic-related effects are adding to powerful underlying forces such as network effects and economies of scale and scope.

The role of M&A deals

Across multiple industries, we now see a trend toward falling business dynamism. Think of a young manufacturer that cannot break out of its local market, or a start-up retailer whose prices are undercut by a big rival that temporarily sells below cost to keep entrants at the door.

These are missed opportunities in terms of growth, job creation, and rising incomes. Our research shows how some firms hold power over wages in labor markets, paying workers less than is warranted by their marginal productivity.

One factor contributing to these trends is the rise of mergers and acquisitions (M&A)—especially by dominant players. While M&A can yield cost savings and better products, it can also weaken incentives for innovation and strengthen a firm’s ability to charge higher prices. Worryingly, our analysis shows that M&A by dominant firms contributes to an industry-wide decline in business dynamism—as competitors across the board take a hit to growth and research and development spending. This is particularly worrisome in a world of low productivity growth.

Implications for policymakers

So, what can governments do? We would like to highlight five priorities—whose importance will vary across jurisdictions.

First, competition authorities should be increasingly vigilant when enforcing merger control. The criteria for competition authorities to review a deal should cover all relevant cases—including acquisitions of small players that may grow to compete with dominant firms. For example, Germany and Austria recently introduced thresholds based on the deal price, in addition to those based on the target’s turnover. Evaluations of past merger decisions could also contribute to more effective enforcement of competition rules.

Second, competition authorities should more actively enforce prohibitions on the abuse of dominant positions and make greater use of market investigations to uncover harmful behavior without any reported breach of the law. In 2018, an Australian inquiry into the dairy industry illustrated the benefits: it led to mandated improvements to contracting practices between farmers and processors.

Third, greater efforts are needed to ensure competition in input markets, including labor markets. Here, vigorous enforcement of rules to prevent ‘no poaching’ pacts between firms would be welcome. Non-compete clauses in some retail and fast-food job contracts also make it harder for employees to move to better-paid jobs—which is especially relevant for low-skilled workers.

Fourth, competition authorities should be empowered to keep pace with the digital economy, where the rise of big data and artificial intelligence is multiplying incumbent firms’ advantage. Facilitating data portability and interoperability of systems can make it easier for new firms to compete with established players. For a precedent of how regulation can enable switching and improve consumer welfare, think of how the European Union boosted competition two decades ago by giving customers the right to keep their cell phone number when switching between operators.

Finally, resources matter. In the United States, for example, the combined budget of the Federal Trade Commission and the Department of Justice’s Antitrust Division is roughly half of what it was four decades ago, as a share of GDP. Across many jurisdictions, investments may be needed to further boost sector-specific expertise amid rapid technological change. The United Kingdom recently announced a new Digital Markets Unit that will govern the behavior of dominant platforms, such as Google and Facebook.

Promising signs for green shoots

The good news is that active reviews of competition policy frameworks are already underway in major economies, including the European Union and the United States. These reviews offer an opportunity that should not be missed. Policymakers should act now to prevent a further, sharp rise in market power that could hold back the recovery.

The crisis will reshape our economies through profound structural shifts that should spur a wave of young, high-growth-firms that innovate and create high-quality jobs. They deserve a level playing field and a fair chance to succeed.

Broader policy support directed to small and medium enterprises is also important, as many small firms have been unable to benefit from government programs designed to help firms access financing during the pandemic. As the recovery takes hold and policy support is gradually withdrawn, it will be even more pressing to ensure that viable small and medium enterprises have access to financing, so they are not put at further disadvantage relative to larger firms.